Of a lot on the web change possibilities only deal with restrict purchases during the pre-industry trading to safeguard people out of volatility. Limit orders are merely done at the a designated price and make certain you never pick for more otherwise sell for shorter in your purchase. Because of volatility, an enthusiastic asset's rates might get off the limitation price. This is going to make pre-market limitation sales susceptible to not performed.

Put simply, it's trade until the typical business occasions begin. Traders explore pre-field moves to judge just how locations you are going to run using full opening. But not, they work below much more limitations sufficient reason for reduced liquidity than through the regular exchange times. The website shouldn't be relied on as an alternative to possess extensive separate marketing research prior to your genuine trading behavior.

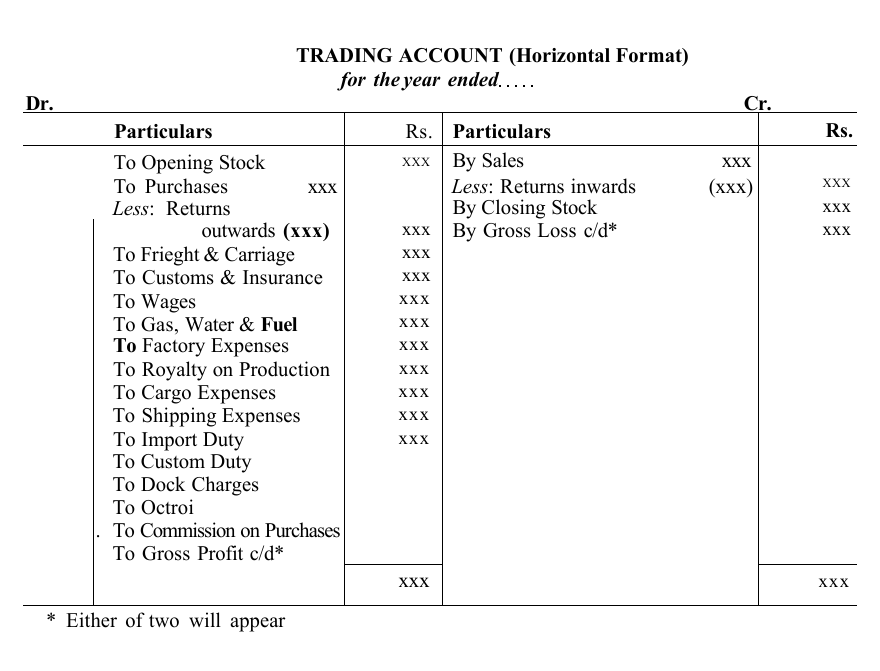

Step: Place Restriction Requests

That have pre-business change, you might place positions before most of the market is prepared to act. Despite this advantage, pre-business trade isn’t rather than certain disadvantages. People rates considering previous overall performance don’t a promise coming performance, and you will prior to any investment you ought to mention your unique money means or talk with a professional elite group. Pre-business and you may once-occasions exchange are also identified collectively while the expanded trade.

- Pre-field trading is actually trade that takes place just before typical stock market opening times.

- Pre-industry exchange is going to be beneficial as a means away from comfort and smaller effect, because the following the issues description.

- You could place buy and sell limit requests during the pre-field days.

- Meanwhile, buyers try getting ready for earnings away from Tesla (TSLA), Alphabet (GOOG), and others this week.

- There has been an increasing demand to extend change occasions within the modern times.

The first place traders need to look to find details about pre-business and immediately after-times pastime is their brokerage account’s study solution, if they have you to. Brokerage information features often deliver the really intricate out of-times field trade research and usually started totally free with a broker membership. Buyers could comprehend the current bid and have charges for specific bonds as well as the change in rates compared to a past period’s intimate.

Opportunity to compete with other buyers

Pre-business, after-occasions, and immediately exchange is used outside normal change instances because of electronic systems one to fits people which have suppliers. Even though it help investors respond to information points external normal exchange times, pre-field and you may once-days trading offers numerous threats, for example illiquidity and speed volatility. It exchange in addition to enables buyers to reply to information and you will organization situations, including money, outside normal exchange days. Even after its pros, premarket exchange and poses tall dangers. Minimal exchangeability helps it be difficult to execute deals from the wished cost. There's also increased amount of price uncertainty, resulted in unforeseen field moves.

Have you been an early bird who would like to invest on your own own schedule? Get our very own newest understanding and you may announcements produced straight to the https://apex-nl.com/ email on the Genuine Buyer publication. You’ll in addition to pay attention to from our change professionals as well as your favorite TraderTV.Live characters. If you are pre-market change is certainly one a lot more chance of their trading portfolio, you'll find more factors and you may cons.

ECNs effortlessly play deals but feature the fresh caveat of limiting purchases solely to your arena of limitation purchases. Premarket trade now offers several benefits, including the possibility to behave early so you can immediately reports, comfort to own people having busy dates, as well as the capability to score ahead of the competition. Yet not, moreover it has dangers for example minimal liquidity, speed suspicion, non-delivery out of limit sales, and you will competition away from organization people. Pre-business exchange try change that happens just before normal stock-exchange opening days. Whilst it was once entirely available to organization investors, much more online agents offer extended trade days to have investors. Pre-field exchange opens possibilities for people to act to your immediately after-times reports which can apply to trading rates during the beginning.

- Furthermore, premarket change is usually controlled because of the organization traders, who have higher information and information, providing them a bonus over merchandising traders.

- But not, the greatest problem for brings would be the fact exchange instances usually are limited.

- You should be able to see the modern bid and inquire charges for particular securities.

- When choosing a brokerage, take a look at trade times, offered holds, exchange regularity, and you will user reviews to determine an established provider that fits their trading needs.

- Field manufacturers commonly allowed to perform purchases through to the typical trade class opens up.

Income

But not, once your membership try discover and you may funded, understand that premarket trade is bound to certain ties, acquisition type and you may rates. To take part in premarket change, it is very important to choose the correct programs offering premarket change features. Of a lot on the internet brokers give access to premarket trading, but people would be to search and evaluate some other networks to get the best fit for their requirements. Experienced investors, preferably that have a thorough understanding of industry patterns and you will premarket reports, work better appropriate browse the brand new volatility and demands found in that it change example. One of several benefits of premarket change is the ability to react punctually in order to right away reports.

Pre-business Us stock moving firms

This can be merely you'll be able to should your pre-business response to news on the a stock is precise as well as the inventory will not completely dismiss the headlines inside the pre-field trading. Pre-business trading is the trade out of property – primarily carries – ahead of typical exchange times. Observe pre-market change can help you reply to at once reports before other investors. Trade depends on having a ready amount of most other buyers waiting to shop for market your own recommended also provides. During the pre-field times, since there are a lot fewer buyers, it could be more challenging to execute some of these positions.

Most other possessions, such as forex and you can commodities, lack pre-business change occasions because they work round the clock to your weekdays. There are several reason why offers of a friends movements greatly in the premarket times. The stock exchange is among the most mixed up in create industry. In america, the amount away from stocks traded every day is worth trillions out of bucks. When you’ve explored holds, ready yourself to behave to the news otherwise press announcements.

These things helps it be more difficult for you to do a trade. Traders that have knowledge of technology and fundamental investigation can use pre-industry instances to find a jump on the group, along with other buyers entering in the normal times. Including, if a trader believes you to a business's income skip have a tendency to affect its share rate, they might take a position in early change,.

After you tune in to her or him speaking of this type of, he's basically talking about premarket exchange. But not, the most significant issue to have brings is the fact trade instances are usually limited. Premarket trading is not available for all of the bonds, and you can alternatives can not be replaced throughout the premarket lessons.

After the brand new article-trading training, these types of stock prices are then accustomed mode the foundation away from premarket rates. Traders features several possibilities whenever they have to trade carries at once and you will not in the pre-industry and you can immediately after-hour date harbors, meaning out of 8 p.yards. The newest York Stock market (NYSE) produced immediately after-instances trade within the June 1991 because of the extending trade occasions because of the a keen hours.