Post the brand new page by the prolonged deadline (October 15 for twelve months taxpayers) on the following the target. Resident aliens is to file Setting 1040 otherwise 1040-SR at the target revealed in the Recommendations to possess Function 1040. The new due date to own filing your return and you can spending any tax due try April 15 of the year pursuing the season for that you are processing an income (but understand the Idea, earlier). If you did not have a keen SSN (or ITIN) granted to your or before due date of one's 2024 return (and extensions), you will possibly not claim the kid income tax borrowing to your either your brand new otherwise an amended 2024 return. While you are married and choose as a great nonresident partner treated since the a resident, as the said inside section step one, the guidelines associated with the section do not affect your to have you to definitely 12 months. If you allege a foreign taxation borrowing from the bank, you are going to tend to have to attach on the get back a questionnaire 1116.

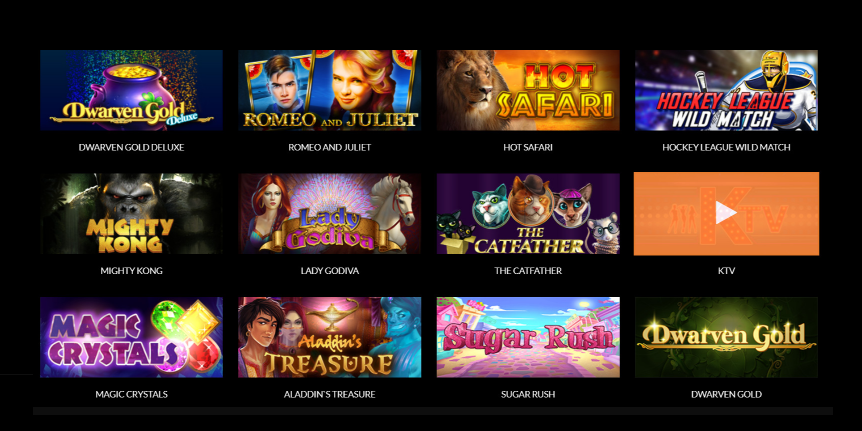

Incentives and you may Promos: cuatro.5 - best ecopayz casinos uk

Advantages conferred by Article 18(1) are excepted from the saving term less than Article 30(3) of one's pact. Jacques is not required to declaration the brand new French societal defense benefits to your Form 1040 otherwise 1040-SR. All the treaties has provisions for the exclusion cash gained by the particular staff away from foreign governments. But not, a positive change can be obtained one of treaties on just who qualifies because of it benefit. Lower than of many treaties, aliens that U.S. owners don’t meet the requirements. Below most treaties, aliens who are not nationals or sufferers of your overseas country do not meet the requirements.

You might be able to love to lose all of the money from real estate while the effectively linked. A delivery you don't eliminate since the get regarding the product sales or exchange of an excellent U.S. real estate focus can be included in your own gross income since the a consistent bonus. Specific exclusions apply at the look-thanks to rule to have withdrawals by QIEs.

We will inform you whenever we find the brand new no-deposit incentives and you can discover our very own newsletter with unique incentives weekly. Two of the most widely used put actions in the The new Zealand is Poli and you can Neosurf. Poli are a lender transfer provider when you are Neosurf is actually a third-people discount alternative.

Knowledge protection deposit conditions

For individuals who wear’t feel the full shelter deposit number or you wear’t require your finances stuck on the deposit to your term of your rent, you've got several options. These types of alternatives enables you to keep a lot more of your offers by within the deposit to you or providing you a minimal-fee mortgage. If you can't spend the deposit or simply just will not want your money tied inside anybody else’s checking account to possess a-year or more, you may also make use of investigating deposit choices. You might be capable of getting a condo, especially another apartment development, that provides downpayment insurance coverage or a substitute for spending a great old-fashioned advance payment.

- Simultaneously, you can also either provides max cash-out membership linked with specific incentives and will be offering.

- Another gains is actually susceptible to the newest 31% (or straight down treaty) price rather than reference to the newest 183-day-rule, chatted about later.

- You are handled since the found in the united states to your any time you are myself found in the world any moment during the day.

- We’re maybe not a lawyer, therefore we is’t provide people information or opinions regarding the you are able to legal rights, cures, defenses, choices, set of forms otherwise procedures.

Have the Adventure having Sloto'Cash's Personal 100 percent free Revolves Render

Allege the newest taxation best ecopayz casinos uk withheld since the a payment on the internet 25e or 25g from Form 1040-NR, as the compatible. If the casualty otherwise thieves loss try owing to a federally announced emergency, you could potentially deduct your own losings even if your home is not associated with a good U.S. change otherwise business. The house or property is going to be private-fool around with assets or earnings-generating assets not linked to a great U.S. trade or team. The house or property have to be located in the All of us in the period of the casualty otherwise thieves. You could deduct thieves losses only around where you will find losing.

Attention on the debt out of your state or governmental subdivision, the new Section of Columbia, otherwise a You.S. territory can be not included in money. Although not, focus on the particular personal hobby bonds, arbitrage bonds, and you can specific ties perhaps not in the joined form is roofed inside the money. A foreign nation try people area under the sovereignty away from a government on top of that of your own All of us. A good partner's distributive express of partnership money (or losings) are addressed as the money (or losings) of the spouse. Acquire on the product sales out of depreciable property that's more the total decline adjustments to your house is acquired since if the house were directory possessions, as the chatted about over. These types of laws apply even though the income tax residence is not inside the us.

Moreover it has the newest seabed and subsoil ones submarine parts beside the country's territorial seas over that it features private rights less than global law to explore and you will mine the new absolute information. Attained income from a wife, apart from exchange otherwise organization income and you may a partner's distributive express from partnership income, is addressed because the money of your mate whose services produced the cash. For example, payments to possess look or research in the united states created by the united states, a noncorporate U.S. resident, or a domestic firm come from You.S. source.

DraftKings, FanDuel Promo Password Also offers Open $300 inside Bonuses to have NBA, NHL playoffs

One of the most extremely important actions of having your deposit back is making certain the previous property manager has the new emailing target promptly. Of numerous state legislation provide the landlord that have security if they wear’t discover your address otherwise aren't advised in the legally acceptance amount of time. If you wear’t learn your following address, provide them with a reliable short term mailing address. Make sure to file exactly how and when your mutual your own mailing address together with your prior property manager. The studies have shown a large number of tenants try hazy and you can confused about their rights and how to obtain defense put right back.

Availableness more assist, as well as our income tax pros

An example was if you will rely on the eye money since the money to have day-to-go out life. Only keep in mind name dumps repaying interest more frequently often have less interest rate. When you're a good nonresident alien plus the scholarship isn’t from You.S. offer, this is not susceptible to U.S. tax. See Grants, Offers, Honours, and Honours in the part dos to choose should your grant try away from U.S. offer. A personal shelter number (SSN) need to be equipped on the productivity, comments, and other taxation-related documents. In case your companion does not have that is maybe not permitted get a keen SSN, they have to sign up for one taxpayer identification amount (ITIN).

Are there any wagering criteria of these incentives?

Find Personal Characteristics, earlier, to the origin regulations one pertain. The place otherwise manner of fee is immaterial inside the determining the brand new supply of the amount of money. You should document a statement on the Internal revenue service to determine your residence cancellation go out.